Bitcoin and Ethereum Bull Run Start

Bitcoin Bull Run Flooded Past $30,000. Is One more Crypto Blast on the Way?

Bitcoin and Ethereum A convention on the planet's greatest digital currency makes them messenger the finish of crypto winter, yet a genuine defrost may in any case be some time away.

At the point when Bitcoin plunged from around $30,000 to underneath $20,000 in minimal over seven days last year, Three Bolts Capital fellow benefactor Su Zhu depicted the spiral as the "nail in the final resting place" for his mutual funds.

Bitcoin and Ethereum Fast forward to now, and the biggest digital money has recently remembered that way from $20,000 back to $30,000 in the previous month, however the business is a sad remnant of what it was the last time the token crossed that achievement.

That is on the grounds that few additional coffins were pounded closed in the domino-like flood of liquidations that followed.

Three Bolts' breakdown: Explorer Computerized, Celsius, FTX, Blockfi, Beginning Worldwide, and other previously high-flying new companies.

Obviously while the temperament has worked on contrasted and last year's whole-world destroying energy, the promising Bitcoin bounce back alone won't be sufficient to fix the harm from last year's outrage-filled slump.

"The opinion here doesn't seem like the most recent couple of weeks imply that we can imagine that the most recent 10 months never occurred," said Oliver Linch, the CEO of the exchange stage Bittrex Worldwide, talking uninvolved with a crypto meeting in Paris.

"Yet, there is unquestionably an inclination that perhaps this signals that a line can be drawn under those outrages and we can return to surveying - and esteeming - crypto without all the commotion from the reports and bad behavior."

That supposed bad behavior has drawn a downpour of administrative examination and high-profile requirement activities in the US.

Among the most noticeable: FTX's Sam Bankman-Seared is anticipating preliminary on misrepresentation charges;

Do Kwon, prime supporter of the Land blockchain, is confronting arraignment for his job in that undertaking's breakdown;

Binance and its Chief Changpeng ``CZ Zhao have been sued by the Ware Fates Exchanging Commission for various asserted infringement;

Coinbase Worldwide Inc. has gotten notice that the Protections and Trade Commission expects to sue the organization. Binance and Coinbase have denied any bad behavior; Bankman-Seared has argued not blameworthy.

Silvergate Capital Corp:Then, at that point, there is the new disappointment of the crypto-accommodating banks Silvergate Capital Corp., Mark Bank and Silicon Valley Bank. While frequently referred to as a bullish impetus for Bitcoin, since they restored its history as an option in contrast to conniving banks, the defeat of those loan specialists likewise cut off key connects to the US monetary framework, assisting with making the once-encouraging future of the crypto business as questionable as could be expected.

Large numbers of the retail financial backers consumed by last year's dive in costs seem, by all accounts, to be recuperating, as opposed to facing new gamble, challenges how much cash engaged with decentralized finance projects stays repressed. While the all out worth of coins got into DeFi projects is up over 25% starting from the start of January, at about $50 billion it is as yet a negligible part of the $180 billion pinnacle arrived at in December 2021, as per the DeFiLlama site.

Simultaneously, a great many positions have been lost in the business and employment has not gotten back. In an indication of supply for ability actually surpassing interest, blockchain project Concordium got more than 350 applications for several new employment opportunities, said its prime supporter and executive Lars Seier Christensen. "The space is developing a little, understanding that the cash tree accessible two or a long time back has wilted a little," he said.

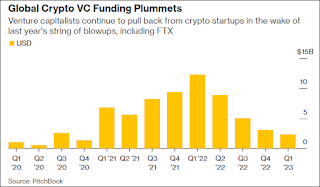

Speculations from investment firms have eased back emphatically. Confidential subsidizing for crypto new businesses all around the world tumbled to $2.4 billion in the primary quarter, a 80% decay from its unsurpassed high of $12.3 billion during a similar period last year, as per PitchBook.

"A ton of the business is still on pause-and-see mode," said Matteo Dante Perruccio, global president at crypto abundance director Wave Computerized Resources. "There has been a trip to quality and the recipients are those organizations that weren't hit by the crypto winter."

Another way this move higher is unique: The eye-popping 83% assembly in Bitcoin this year has not been matched by more current coins. Ether, which enormously outflanked Bitcoin from 2020 and 2021, is up 71% this year. The Bloomberg World DeFi File that tracks the biggest decentralized-finance conventions has recoupled somewhere around one-10th of last year's 2,000-point drop.

"We could be seeing an instance of merchant fatigue joined with a reestablished bullish story following the financial emergency, all blended in with commonly low liquidity that has helped BTC's cost toward the potential gain," said Clara Medalie, overseer of examination at market-information supplier Kaiko.

Regardless of the entirety of the anguish and vulnerability, progress in the development of the business has proceeded. Ethereum this week finished what has all the earmarks of being an effective move up to its organization. The supposed Shanghai update, which empowers financial backers to pull out Ether coins that they had secured in return for remunerations as a component of a "proof-of-stake" framework to defend the organization, could bait billions of dollars into Ether even after SEC Seat Gary Gensler showed he accepts that token should be controlled as a security. The cost of Ether transcended $2,000 this week without precedent for a half year.

"I don't believe there's the lunacy or zeal we saw at $30k or $40k, however there is still, in the background, calm advancement,

" Simon Taylor, head of procedure at Sardine, a misrepresentation counteraction startup whose clients incorporate fintech and crypto organizations.

The large scale picture has additionally changed, possibly to improve things. A year prior, the Central bank and other national banks were just starting what might turn into a progression of loan fee climbs that switched a years-in length strategy of pain free income. Once more with the finish of that fixing cycle now nearer within reach, the circumstances might be ready for a crypto support.

One unavoidable issue is the way energetic customary monetary organizations will be going ahead, and whether they'll step in to fill the jobs once played by fizzled crypto new businesses like FTX.

There are a few signs that could occur. Nasdaq Inc., for instance, expects its guardianship administrations for computerized resources to be sent off before the second quarter.

For a really long time, as much as $5 trillion might progress into new types of cash, like national bank computerized monetary standards and stablecoins, by 2030, as indicated by a Citigroup research study. Another $5 trillion worth of customary monetary resources could be tokenized, assisting drive with massing reception of blockchain innovations, as per the report.

All things being equal, for Michael Purves, the CEO of Tallbacken Capital Guides, the "'show me' edge" will be higher this time around for institutional financial backers, taking into account the job crypto is intended to play in a portfolio is a moving objective. When promoted as a fence against expansion like a Web age gold it rather tumbled during the most terrible customer cost flood since the 1980s

.

"Establishments began to treat Bitcoin in a serious way after Bitcoin broke $20,000 in 2020 and assumed a vital part in the resulting rally to $69,000," he wrote in a new note to clients. "Be that as it may, this time around, it's more drawn out term history of not giving portfolio enhancement will weigh intensely on foundations, which likely have greater migraines to stress over.

.webp)

.png)

No comments:

Post a Comment